Most of the manufacturing entities with which we come into contact want to use their new ERP system for production scheduling purposes. One of the first questions that people tend to ask us regarding this topic is, “Can you change production schedules via drag and drop?” While this feature demos well, there are far more sophisticated questions that should be asked of ERP software vendors relative to production scheduling functionality. Read More…

Almost all manufacturing companies with whom we talk share the following characteristics:

• They are capacity constrained in at least some portion of their production environment.

• They run a mix of make-to-stock and make-to-order production.

• There are certain products that may be produced on a very short lead time (as hot orders) that could be thrown into the production schedule the same day they’re ordered by customers.

• There are complexities to process changeover in such a manner that producing all products of a given family or with certain shared characteristics (i.e., all products of the same color in a painting operation) is imperative to maximize production throughput and minimize off-spec production and process changeovers.

One of the first questions that a manufacturer should ask potential software vendors is whether their system performs finite capacity scheduling or infinite capacity scheduling. With finite capacity scheduling, one can establish process and machine capacities which can be taken into account. By doing so, the manufacturer who is capacity constrained can establish a realistic tentative production schedule by not allowing the system to produce a scenario that couldn’t possibly be performed. If, for example, you only have production capacity within a given work center or have associated labor availability to produce 300 units of a given item per hour, it makes absolutely no sense to have your ERP system generate an unconstrained production schedule with 3-4 fold that amount of production per hour being assumed to run through that work center or with the given number of laborers.

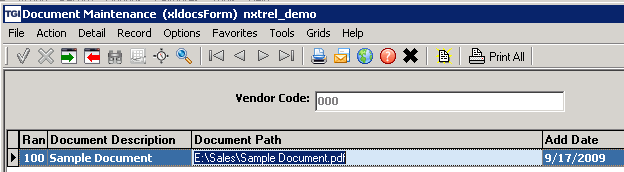

Next, what capabilities does the given ERP system have to manage both make-to-stock and make-to-order production? Make-to-stock production would generally be scheduled based on a signal – either traditional time-phased inventory management processes like MRP or via an electronic signal of similar nature. Make-to-order production would be done by enabling business rules within the system to evaluate the given finished good’s bill of materials or formula, determine whether or not all required raw materials and ingredients were available, and if not, when they could be available via supply chain management, what available production capacity exists to produce the given item, and having the system schedule the production while concurrently generating any required purchase requisitions. Within Enterprise 21, this description of capabilities embodies the collective functionality of Available and Capable to Promise plus Make-to-Order and Automated Supply Chain processing.

Assuming your organization runs with make-to-order processing and allows customers to place such orders on short cycle times (i.e., produced the same day they’re ordered), then it is imperative to leave production capacity available for the placement of these make-to-order items on the same day’s production schedule. For example, if your organization runs two, eight-hour production shifts, and typically has four hours of short-cycle make-to-order production to perform each day, then it makes sense to set up your finite capacity scheduling processes to assume a maximum of twelve hours for make-to-stock production for the given day.

Finally, ERP systems like Enterprise 21 enable scheduling using schedule groups. In this case, products with like scheduling characteristics can be placed in the same scheduling group and these items would be placed in the production schedule consecutively. As well, one can establish scheduling group rules such that certain scheduling groups would follow the completion of other scheduling groups. As an example, in a painting operation where products being produced were white, red, and blue respectively, this would be a likely ordering of production to try to minimize the production of pinks and purples as color changeover occurred.

Similarly, where applicable, manufacturers should be able to build machine “clean out” or “wash down” time into the production schedule between the production of two different schedule groups. For example, a food manufacturer who produces certain items that contain peanuts or other food allergens followed by other items that cannot contain peanuts on the same production machine will need to have machine clean out time built into the production schedule between those two respective schedule groups.

So, if you’re a manufacturer with any reasonable level of complexity in your manufacturing processes, don’t be drawn like a moth to the flame during software demonstrations. Dig deeper into ERP systems’ manufacturing scheduling functionality so you have a broader set of requirements beyond, “Does your production scheduling system support drag and drop functionality?”